Small Cap Growth

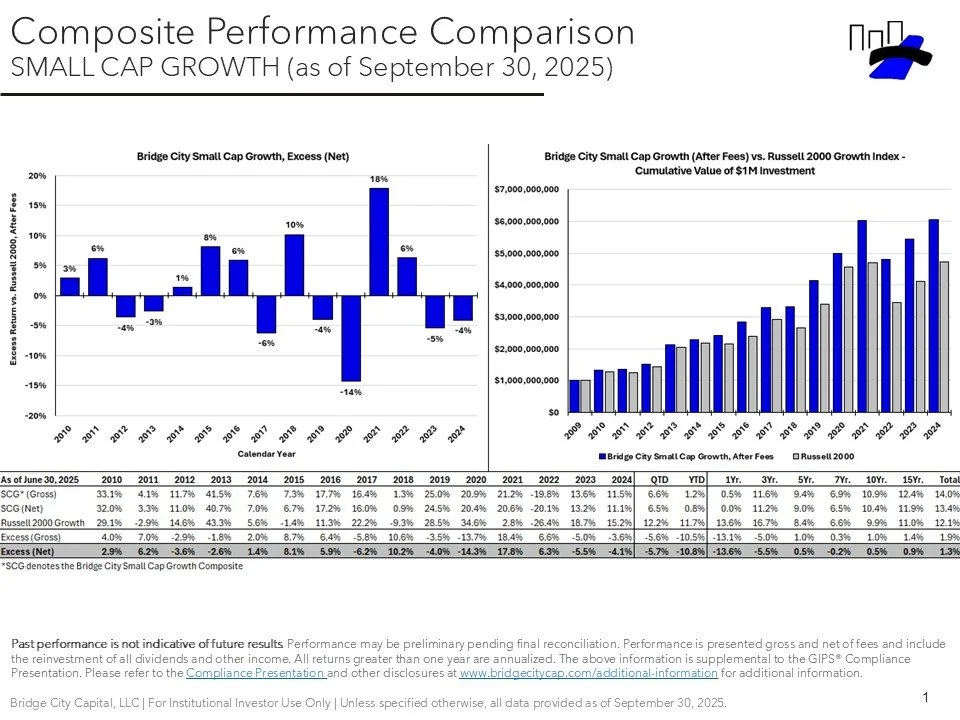

Objective: To outperform the Russell 2000 Growth benchmark by 150 to 200 bps annualized, over a normal market cycle, gross of fees.

Our Small Cap Growth strategy (SCG) is focused on investing in quality small cap growth companies with proven track records, strong financial characteristics, and above-average growth prospects at attractive valuations. We believe this quality-centric strategy will lead to strong relative returns over the long run.

Bridge City's investment process provides a disciplined framework to guide investment decisions. It helps us identify high-quality small cap growth companies by measuring and assigning numerical values to each company's qualitative characteristics, growth & profitability metrics, and financial strength. Valuation is assessed using internally developed earnings projections. Resulting scores help avoid story stocks with flawed fundamentals and gauge a company's relative attractiveness against its peers to identify the highest quality companies trading at attractive valuations.

Our SCG strategy is long only. Portfolio construction aims to isolate performance to stock selection by being fully invested, diversified, and targets neutral sector allocation, as defined below.

Strategy

Benchmark: Russell 2000 Growth Index

Inception: July 1, 2009

Vehicles:

Separate accounts

M3Sixty Small Cap Growth Fund (MCSCX). Visit M3Sixty Funds to learn more.

Portfolio Construction

Fully Invested: <5% Cash

Diversified: 65-100 stocks

Position size: approximately 0.5% to ≤ 3.0%

Market caps bracketing the benchmark

Target Sector Neutral: The greater of:

+/- 20% of the weight of the Russell 2000 Growth Index defined sectors, or

+/- 3 absolute percentage points from the defined sector weights within the index.